Full disclosure: As SpotMe/Onomi’s CEO, I have skin in the game. We have been named as a Leader in Forrester’s All-In-One Event Management Platforms (“EMP”) Wave. While this is big for us, what is more significant is what we believe this Wave reveals about the shifts in event technology. Here is my take on why this report matters and what it tells us about where the market is heading.

Who is watching the event tech category? A guide to research coverage

Who is out there scrutinizing, crowning, and predicting what is going on on the market? Well, the FIGs (Forrester, IDC, and Gartner) and a couple of more boutique firms:

In my view, Forrester is offering the premier industry coverage for two reasons:

- They did not just jump on the bandwagon: Forrester has covered event technology for nearly 10 years (starting in 2015 with Laura Ramos)

- They have made substantial contributions to the category: the lead Forrester analyst for the 2024 Wave report, Conrad Mills, has published over 15+ research reports and blogs over the past 2 years, making him the most prolific analyst and authoritative voice in the industry

Evolving criteria: How Forrester’s evaluation changed from 2023 to 2024

Forrester identified 12 top “all-in-one event management platform” (that’s the category name) vendors in the market – all of which tick these 3 boxes:

- All-in-one event management platform capabilities, i.e. can execute in-person, hybrid, and virtual events

- Over $10 million in annual revenue

- A high level of interest from Forrester clients

G2 says there are 190 event management platforms on the market, so it’s helpful to put strict inclusion criteria. For example, I can imagine that >80% of the 190 vendors do not qualify for the $10 million annual revenue criteria. Vendors are then ranked against 31 criteria grouped into 2 categories: current offering and strategy.

In their 2024 assessment, Forrester has made two radical shifts in how they selected and assessed platform vendors:

- Only “all-in-one” vendors: Forrester focused only on vendors that can serve enterprise event programs from end-to-end, across all event formats (virtual, hybrid, and in-person). This is primarily driven by the growing expectation from buyers to consolidate tech stacks, for cost, operational efficiencies, and integration purposes.

- Customer feedback: While Forrester historically included revenue as a criterion in the market presence category, since they launched in 2024, Waves now focuses on Customer Feedback for the third dimension of the assessment (represented by halos on the graph). I would argue that past a certain size threshold, customer satisfaction becomes the primary competitive differentiator, not top-line numbers, and Forrester seems to feel the same.

How SpotMe/Onomi scored in this Wave and what I think about it

Let’s face it, the event technology landscape is difficult to navigate. On a recent analyst call (not Forrester), it was pointed out to me that buyers find it difficult to differentiate one solution from another, especially when vendor websites are carbon copies (“I could literally replace your logo with any competitor on your website and I could not tell the difference”). Fair point. Ergo, the depth and breadth of the Forrester Wave is one of the few resources that helps buyers cut through the noise and understand what makes each solution unique.

A couple of years ago, I wrote an email to my team titled “Bringing back the R into the CRM.” The premise was simple yet powerful: CRM systems had lost their focus on actual relationships (remember, the R in CRM means “relationship”), becoming mere transaction databases.

Meanwhile, customer behavior was shifting – they increasingly avoided interactions with sales, except at events. This is true for every vertical – including life sciences. Events remained one of the few touchpoints where meaningful relationships could be built. Our strategy anchor was born: develop the industry’s deepest CRM integration, not as an afterthought but as a native application within the CRM itself. We even took it a step further, envisioning sales-facing event management capabilities living directly inside the CRM.

This strategic clarity meant making tough choices: after all, strategy is about deciding what not to do. We placed our bets heavily on CRM integration and industry specialization, particularly in life sciences – a sector we’ve served for over 15 years, and which culminated in the launch of Onomi earlier this year. This focus meant we consciously chose to maintain only basic capabilities in certain areas (e.g. registration, though we’re now actively closing these gaps).

Our “superior vision” (dixit Forrester) around CRM-centricity wasn’t born from market research or a McKinsey deck – it emerged from deep reflection on where the industry was headed and what our customers really needed. The report’s acknowledgment of our “deep sector knowledge” and “differentiated solutions for target markets” validates our belief that in a world of look-alike event tech, specialization and focus are key differentiators.

Now, this might seem counter-intuitive in a market where vendors often try to be everything to everyone. But as the Wave report suggests, sometimes doing fewer things exceptionally well – with deep industry knowledge and unmatched customer support – creates more value than trying to be a jack-of-all-trades.

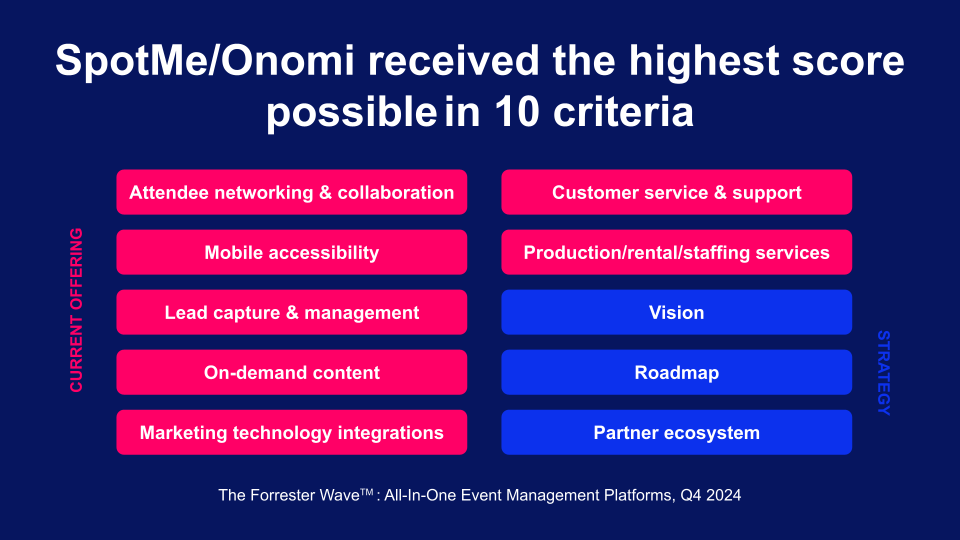

If you are curious, here are all the areas where SpotMe achieved the highest score possible:

Decision time: 3 takeaways for enterprise buyers

- Industry-focus matters. One-size-fits-all is not a thing. There are fundamental differences across industries and use cases that call for a specific set of capabilities to meet user experience, compliance, and IT requirements. Find the solution that serves your use cases for life sciences, not the other way around.

- Feedback trumps size. No one ever got fired for buying IBM, sure. But who likes IBM? As much as events have become increasingly technology-dependent, they remain intrinsically built on human interactions. The quality of support, professional services, and expertise are just as valuable as product capabilities. Don’t get bullied by IBM.

- CRM-First: If you are serious about event ROI and scaling commercial effectiveness with events, your events have to live in your CRM. Period. While at a distance, CRM integrations might seem straightforward, there is a great deal of thought in getting it right. Evaluate CRM integrations very closely.

What is Onomi?

The event-centric customer engagement solution that 15 of the top 20 life science companies use to deliver personalized, engaging & compliant experiences for HCPs.

From webinars and advisory boards to in-person congresses and standalone meetings, Onomi helps you implement successful omnichannel strategies through deep native CRM integrations, including Veeva.

To find out more, talk to someone about how Onomi could help you in 2025.